AN INTRODUCTION TO INVESTMENTS

Why Individuals Should Specify Investment Goals: The stock market is the single greatest wealth redistribution mechanism created by man to take money from the impatient and transfer it to the patient. Patient (kiên nhẫn) does not mean inaction (không hoạt động). How to limit the loss, how to maximize the profit is to understand the companies we're invested in. A good business tends to stay a good business, no matter what its stock price does.

Staying Invested: No one likes to lose money. We often wonder if we should sell our investments to stem further losses, or sit on the sidelines until things improve. But in most cases, the wisest move is simply to stay the course. Small and large stocks have provided the highest returns and largest increases in wealth over the previous years. However, the higher returns achieved by stocks are associated with much greater risk. Government bonds and Treasury bills are guaranteed by U.S. government as to the timely payment of principal and interest, while stocks are not guaranteed and have been more volatile than the other asset classes. Furthermore (hơn nữa, vả lại), small stocks are more volatile than large stocks, are subject to significant price fluctuations and business risks, and are thinly traded.

Investing During Market Downturns: Stocks are not guaranteed and have been more volatile than other asset classes. But ceasing (dừng, ngừng) regular investments during market downturns can sometimes deprive (lấy đi, cướp đi) you of future opportunities. The best strategies for handling market downturns includes maintaining a well-diversified portfolio (a diversified investor's portfolio may include stocks consisting of retail, transport, and consumer staple companies, as well as bonds—both corporate- and government-issued) and using dollar-cost averaging (dollar-cost averaging is the practice of putting a fixed amount of money into an investment on a regular basis, when the prices fall) instead of lump-sum purchases, to ease into new investments. Dollar-cost averaging does not ensure a profit or protect against a loss in declining markets. Dollar-cost averaging involves continuous investment regardless of fluctuating prices, so investors should consider their financial ability to continue purchases through periods of low price levels. Finally, staying focused on a long-term investment plan may enable us to participate in recoveries. Diversification (làm cho thành nhiều dạng) does not eliminate the risk of investment losses.

SPONSORED CONTENT

Your Service Flyer

Your Event Invitation

Your Promotion Ads

Your Logo & Brand

Support us and grow your business with us. My goal was to make technical information available with ready access to commonly needed resources, formulas, and reference materials while performing my work as a Technical Support Engineer. The businesses listed in the Sponsored Content section were randomly selected because of their uniqueness. However, non-sponsored selected ads will be rotated monthly.

Viba Direct lacks an advisory board to do research and hire writers with the latest technological knowledge. Creating an effective advisory board requires more than an invitation. Without your sponsorship, this is not possible. If your company is interested in placing the company's logo, brand, event invitation, and other promotional banners and flyers here or on any other pages. Please Customer Service for more detail.

Rather than trying to pick individual stocks during a market downturns, pick companies that tend to have these characteristics:

- The ability to increase prices rather easily (even when product demand is flat and capacity is not fully utilized) without fear of significant loss of either market share or unit volume.Khả năng tăng giá khá dễ dàng (ngay cả khi nhu cầu sản phẩm không đổi và công suất không được sử dụng hết) mà không sợ mất thị phần hoặc sản lượng đơn vị đáng kể. Thị phần là tỷ lệ phần trăm giữa doanh thu bán ra của doanh nghiệp này với tổng doanh thu của tất cả các doanh nghiệp kinh doanh loại hàng hoá, dịch vụ đó trên thị trường liên quan hoặc tỷ lệ phần trăm giữa doanh số mua vào của doanh nghiệp này với tổng doanh số mua vào của tất cả các doanh nghiệp kinh doanh loại hàng hoá, dịch vụ đó trên thị trường liên quan theo tháng, quý, năm.

- The ability to accommodate large dollar volume increases in business (often produced more by rising in price than by real growth) with an only minor additional investment of capital. Khả năng đáp ứng khối lượng đô la lớn tăng lên trong kinh doanh (thường được sản xuất nhiều hơn do giá tăng hơn là tăng trưởng thực tế) chỉ với một khoản đầu tư vốn bổ sung nhỏ.

Investing for The Long Run: Why invest in the long run? Individual stocks tend to have highly volatile prices, and the returns we might receive on any single stock may vary wildly. In addition to being volatile, there is the risk that a single company’s stock price may not increase significantly over time. But if we invest in the right stock, we could make bundles of money. On the downside, since the returns on stock investments are not guaranteed, we risk losing everything on any given investment. Therefore, if we put all of our eggs in a single basket, sometimes that basket may fail, breaking all the eggs. The average yearly difference between the high and low of any given typical stock is about 40%. When the stock market has crashed, it has always rebounded. As we hold a blue-chip-stock for year after year, the variation on its expected return typically increases. Tại sao nên đầu tư lâu dài? Giá các cổ phiếu cá thể thường có xu hướng biến động mạnh và lợi nhuận mà bạn có thể nhận được trên bất kỳ cổ phiếu nào có thể khác nhau rất nhiều. Ngoài việc dễ hay thay đổi, rủi ro nữa là giá cổ phiếu của một công ty có thể không tăng đáng kể theo thời gian. Nhưng nếu bạn đầu tư vào đúng cổ phiếu, bạn có thể kiếm được nhiều tiền. Mặt khác, vì lợi nhuận từ các khoản đầu tư cổ phiếu không được đảm bảo, bạn cũng có nguy cơ mất tất cả trên bất kỳ khoản đầu tư nhất định nào. Do đó, nếu bạn bỏ tất cả trứng vào một giỏ, đôi khi giỏ đó có thể bị rớt, làm vỡ tất cả trứng. Chênh lệch trung bình hàng năm giữa mức cao và mức thấp nhất của bất kỳ cổ phiếu điển hình nào là khoảng 40%. Khi thị trường chứng khoán tuột thấp, nó luôn phục hồi. Khi bạn nắm giữ một cổ phiếu tốt từ năm này qua năm khác, sự thay đổi về lợi nhuận kỳ vọng của bạn thường tăng cao.

Invest in During Times of Inflation. For most of us, inflation means higher prices on goods and services, and the risk of a loss of purchasing power if their income fails to keep up. Conversely, a decline in prices is known as deflation. Inflation is most damaging to the value of fixed-rate debt securities because it devalues interest rate payments as well repayments of principal. If the inflation rate exceeds the interest rate, lenders are in effect losing money after adjusting for inflation. This is why investors sometimes focus on the real interest rate, derived by subtracting the inflation rate from the nominal interest rate. As an example, when the inflation rate is 3%, a loan with a nominal interest rate of 5% would have a real interest rate of approximately 2% (in fact, it's 1.94%). Đầu tư vào thời kỳ lạm phát. Đối với hầu hết chúng ta, lạm phát có nghĩa là giá cả hàng hóa và dịch vụ tăng cao, và khả năng tiêu xài nếu thu nhập của bạn không tăng theo kịp. Ngược lại, sự giảm giá được gọi là giảm phát (Sự giảm bớt số tiền giấy phát hành để tiền có giá trị hơn, trái với lạm phát.) Lạm phát gây tổn hại nhiều nhất đến giá trị của các chứng khoán với nợ có lãi suất cố định vì nó làm giảm giá trị các khoản thanh toán lãi suất cũng như trả nợ gốc. Nếu tỷ lệ lạm phát vượt quá lãi suất, người cho vay sẽ mất tiền sau khi điều chỉnh theo lạm phát. Đây là lý do tại sao các nhà đầu tư đôi khi tập trung vào lãi suất thực, có được bằng cách lấy lãi suất danh nghĩa trừ đi tỷ lệ lạm phát. Ví dụ, khi tỷ lệ lạm phát là 3%, một khoản vay với lãi suất danh nghĩa 5% sẽ có một tỷ lệ lãi suất thực tế khoảng 2%.

How do you protect yourself during inflation? In general, many experts recommend investing smartly to hedge against inflation “KEEP INVESTING IN STOCKS” to hedge against rising costs. Here’s what Warren Buffett has said over the decades. “The best businesses during inflation are the businesses that you buy once and then you don’t have to keep making capital investments subsequently,” while you should avoid “any business with heavy capital investment.” He highlights real estate as good during inflation, which you may buy once and then also get the rise in value as well, which means a company in which the products are in demand even if the company does have to raise prices; meanwhile he calls out businesses like utilities and railroads as not good investments during inflation." Làm thế nào để bạn tự bảo vệ mình trong thời kỳ lạm phát? Nhìn chung, nhiều chuyên gia khuyên bạn nên đầu tư một cách thông minh để phòng ngừa lạm phát “HÃY VẪN CỨ ĐẦU TƯ VÀO CỔ PHIẾU” để phòng ngừa khi chi phí gia tăng. Đây là những gì Warren Buffett đã nói trong nhiều thập kỷ. “Các doanh nghiệp tốt trong thời kỳ lạm phát là các doanh nghiệp mà bạn mua một lần và sau đó bạn không phải tiếp tục đầu tư vốn”, trong lúc bạn nên tránh “bất kỳ doanh nghiệp nào có vốn đầu tư lớn”. Ông nhấn mạnh bất động sản là tốt trong thời kỳ lạm phát, bạn có thể mua một lần và giá trị sẽ được tăng dần, có nghĩa là một công ty có nhu cầu sản phẩm ngay cả khi công ty đó phải tăng giá; trong khi đó, ông ấy gọi các doanh nghiệp với tiện ích đa dụng và đường sắt là những khoản đầu tư không tốt trong thời kỳ lạm phát.

‹•› Companies that tend to withstand an inflationary environment are commodities, bonds, real estate, and stocks.

- Commodities include raw materials and agricultural products like oil, copper, cotton, soybeans, and orange juice. Commodity prices tend to rise alongside the prices of finished products made from those commodities in inflationary environments. For example, higher crude prices elevate the price of gasoline and transportation. Sophisticated investors can trade commodities futures or the shares of producers. On the other hand, exchange-traded funds investing in commodity futures will tend to underperform the price of a rising commodity, because their futures positions must be rolled as they expire.

- Inflation-Indexed Security or inflation-indexed bonds, which offer a variable interest rate tied to the inflation rate. In the United States, Treasury Inflation-Protected Securities (TIPS) are a popular option, pegged to the Consumer Price Index. Inflation-indexed securities guarantee a return that’s greater than inflation, often indexed to the Consumer Price Index (CPI) or another inflation index.

- Historically, real estate has proven to be a stable investment during inflation. Real estate is a popular choice because it becomes a more useful and popular store of value amid inflation while generating increased rental income. But real estate is also vulnerable to rising interest rates and financial crises, as seen in 2007-2008. But evaluating if real estate could be right for your portfolio is more complex than that. One also must take into account the need for liquidity, their tax strategy and also the time they can devote to managing a real estate investment, which tends to be more intensive than a stock portfolio. Nonetheless, when prices are rising, property can often be a favorable place to have your money.

- Stocks have a reasonable chance of keeping pace with inflation—but when it comes to doing so, not all equities are created equal. For example, high-dividend-paying stocks tend to get hammered like fixed-rate bonds in inflationary times. Defensive stocks tend to do better during inflation periods and offer modest dividends. These are your R&D-heavy pharmaceutical and biotech companies that don’t swing with the business cycle of the economy. Companies in the information-technology sector are less sensitive to inflationary pressures, and would also be good individual stock options. Also, investors should focus on companies that can pass their rising input costs to customers, such as those in the consumer staples sector.

Profit In a Down Market Short selling is a tactic used by intermediate to advanced traders to make money from an asset that we don't own. How?

- Identify the stocks that you believe will decline in the future, so that it can be bought back at a lower price to earn a profit.

- Sell the share in the market at the current market price. Collect the proceeds in the margin account.

- Wait for stock price to fall. Buy back the shares at the lower price and return the shares to the lender.

Risks with short sell: Losses can keep mounting - Additional costs - Short squeezes.

- Timing is crucial. Over time, generally markets have moved upwards. Even if your short play is a good idea, the market could continue to carry the stock in the interim.

- Stock borrowing costs. This fee is based on an annualized rate that can range from 1% or more than 100% of the value of the short trade.

- Other fees the short seller also has to pay to the lender (broker) on events such as share splits, spin-offs and bonus share issues, all of which are unpredictable events.

- Dividend payment is the short seller responsible on the shorted stock. Also margin innterest if short positions are kept open over an extended period, the interest payable can add up to a large sum.

- Short squeeze due to positive development in the stock market, the traders rush to buy to cover their positions, which forces short sellers to close out their short positions. This can add even more upward pressure on the stock and typically further moves the price even higher. Stocks with high demand for shorting can have a “short squeeze”.

Rewards with short sell

- To profit in a bearish market, without short-selling, it can be very difficult to make money from a down market.

- To hedge (rào lại) the downside risk of a long position in the same security or a related one with short positions.

Call Options: An option to buy stocks at an agreed price on or before a particular date. For this option to buy the stock, the call buyer pays a “premium” per share to the call seller. If you think the market price of the underlying stock will rise, you can consider buying a call option compared to buying the stock outright. If the stock price moves up significantly, buying a call option offers much better profits than owning the stock. If you think the market price of the underlying stock will stay flat, trade sideways, or go down, you can consider selling or “writing” a call option.

Call Options, the Strike Price: The strike price of a call option is a fixed price at which the owner of the option can buy, or sell, the underlying security or commodity. If you're in the long call position, you want the market price to be higher until the expiration date. When the strike price is reached, your contract is essentially worthless on the expiration date (since you can purchase the shares on the open market for that price). You can sell a Call option before it hits the Strike price. If the stock price exceeds the call option's strike price, then the difference between the current market price and the strike price represents the loss to the seller. Most option sellers charge a high fee to compensate for any losses that may occur. When the stock trades at the strike price, the call option is “at the money.” If the stock trades below the strike price, the call is “out of the money” and the option expires worthless. Then the call seller keeps the premium paid for the call while the buyer loses the entire investment.

Calls Option Strategy: A call option (quyền đặt tiền) is a contract between a buyer and a seller. This contract is an agreement that gives the buyer the right to buy shares of the “company,” at a pre-determined price for a limited time period. The “company” is generically known as the underlying security. Options can be traded on several types of underlying securities. Some of the most common ones are stocks, indexes, or exchange-traded funds (ETFs) stock options. The meaning of a call option is that when we own one, we have the right to call the asset away from the investor. Most stock option contracts are a right to buy 100 shares of the underlying security. So the “company” represented in our contract will be 100 shares of a specific stock, like Intel, Apple, or Adobe. Once the contract between the buyer and seller is final, the seller is required to sell the stock to the buyer at the price determined in the contract, if the buyer decides to buy the 100 shares of stock. This is referred to as “exercising” the buyer’s right. A call option is called a "call" because the owner has the right to "call the stock away" from the seller.

Chiến lược với quyền mua hoặc bán cổ phần với giá đặt trong một thời gian cố định: Quyền đặt tiền là một hợp đồng giữa người mua và người bán. Hợp đồng này là một thỏa thuận cho người mua quyền đặt tiền trên cổ phiếu của “công ty”, với mức giá được xác định trước trong một khoảng thời gian giới hạn. “Công ty” thường được biết đến như một chứng khoán cơ bản. Một số loại chứng khoán cơ bản có thể được mua bán với quyền đặt tiền. Quyền đặt tiền phổ biến nhất là cổ phiếu, chỉ số, hoặc quỹ giao dịch hoán đổi (ETF). Ý nghĩa của quyền đặt tiền là khi chúng ta sở hữu một chứng khoán cơ bản, chúng ta có quyền đặt tiền vào chứng khoán của nhà đầu tư. Hầu hết các hợp đồng với quyền đặt tiền là quyền mua 100 cổ phiếu chứng khoán cơ bản. Vì vậy, "công ty" đại diện trong hợp đồng của chúng ta sẽ là 100 cổ phiếu, cụ thể như Intel, Apple hoặc Adobe. Khi hợp đồng giữa người mua và người bán kết thúc, người bán được yêu cầu bán cổ phiếu cho người mua theo giá xác định trong hợp đồng, nếu người mua quyết định mua 100 cổ phiếu. Điều này được gọi là quyền "thực hiện" của người mua. Quyền chọn mua được gọi là "quyền mua" bởi vì người sở hữu có quyền "lấy cổ phiếu đi" từ người bán.

This right to buy is a limited time offer. The shares of the underlying asset are available at a specific, pre-determined price — the strike price or exercise price — during a specific timeframe (the expiration date) from a seller. Exercise our right to buy, and the seller is obligated to sell us the underlying security. Once the predetermined window of time ends, we are no longer able to buy the underlying shares for the strike price.

- How does it work? Ex: ABC stock is trading for $20 a share. Calls with a strike price of $20 are available for a $2 premium and expire in six months. In total, one call contract costs $200 ($2 premium x 100 shares). The contract represents 100 shares, for every $1 increase in the stock price above the strike price, the total value of the option increases by $100. The breakeven point is $22 per share. That’s the strike price of $20 plus the $2 cost of the call. When the stock trades between $20 and $22, the buyer would regain some of the initial investment, but the option does not show a net profit.

- How does it work? Ex: We purchase a call option contract for 100 shares of an biotech stock and pay $2.15 for the option. This contract gives us the right to buy these shares for $50 each at any point during the next three months. During this time, the price of this stock goes up and up. Near the end of your option contract, you purchase the underlying security for the strike price of $50 per share — a cost that’s cheaper than the $55 per share the stock is currently trading at. In this situation, our option is "in-the-money" (in the money (ITM) and out of the money (OTM) is a matter of the strike price's position relative to the market value of the underlying stock).

- Calculating our profit. Subtract the strike price from the current price. If the biotech stock is trading at $55, the strike price is $50, and the premium is $2.15, your profit is $2.85 per share. Our call option contract was for 100 shares, so our total profit is $2.85 multiplied by 100, or $285, less commissions. Commissions are an important factor to figure into all options trades. PROFIT = CURENT PRICE – STRIKE PRICE + PREMIUM X 100 ($55 – $50 – $2.15 = $2.85) X 100 = $285 – COMMISSIONS.

- Calculating our loss. If the underlying stock price is less than the strike price at the end of the contract, which means there is no value to own it. The underlying shares of biotech stock have a strike price of $50 per share. After three months at the expiration date and the price of the stock is now $47.75 per share. Since the current price is below the strike price of $50, we obviously decided not to buy the underlying shares and we’ve already paid the premium up front. LOSS = PREMIUM X 100 ($2.15 X 100) = $215 – COMMISSIONS. This is often referred to as maximum loss.

Quyền mua này là một ưu đãi có thời hạn. Cổ phiếu cơ bản của công ty sẵn có với một giá cụ thể, được xác định trước - giá thực tế (có giá trị) hoặc giá áp dụng (đúng với yêu cầu) - trong một khung thời gian cụ thể (ngày hết hạn) từ người bán. Thực hiện quyền mua của bạn và người bán bắt buộc phải bán cho bạn chứng khoán ưu đãi đó. Sau khi khoảng thời gian định trước kết thúc, bạn không thể mua cổ phiếu cơ bản đó với giá cụ thể nữa.

- Mua bán thế nào? Với quyền đặt tiền hợp đồng bạn chọn mua 100 cổ phiếu của một công ty sinh học và trả $2.15 với quyền đặt tiền. Hợp đồng này cho bạn quyền mua những cổ phiếu này với giá $50 mỗi cổ phiếu vào bất kỳ thời điểm nào trong ba tháng tới. Trong thời gian này, giá của cổ phiếu này mổi ngày càng lên cao. Gần cuối hợp đồng với quyền chọn, bạn mua mỗi cổ phiếu cơ bản nầy với giá thực tế là $50 - rẻ hơn $55 là trị giá cho mỗi cổ phiếu hiện đang giao dịch. Trong tình huống này, lựa chọn của bạn là ("in-the-money" giá cụ thể thấp hơn giá cổ phiếu hiện tại).

What Make A Good Company? A blue chip company is a mature company with a national reputation for quality, reliability, and the ability to operate profitably in good and bad times. The most popular index that follows United States blue chips is the Dow Jones Industrial Average, a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry. All companies in the Dow Jones Industrial Average (DJI) are blue-chips, but the Dow Jones Industrial Average is an index that does not include all companies that are blue chips. Review a company financial statements and earnings to gain insight into how the company is doing.

- Is the company making a profit?

- Can it pay its debts?

- Are revenues growing year-to-year?

Place A Limit Order: Buying a stock is not a one and done action in this choppy market. We need to systematize our approach so we can limit our losses. Let’s say we have $10,000 we’re planning to invest in a stock. We want to buy Novavax, Inc. (NVAX), but we’re leery of the broader market and that the stock is trading near all-time highs. Here’s our approach.

- We can buy half a position today for $36.95. We have now invested $3,695. We place a limit buy order for the rest of our position at some radically lower level. We call it our ‘wish list’ price. For us, we would do it like this. We see where the stock topped, it hit a flat area, and then bounced as a bottom all at about $17 a share. We see that price and think, why not own NVAX for $17. So, we place a limit order to buy the second half of our position for $17.

- If we learn option trading. Option trading can actually increase our return even if the lower price is never reached. Selling a put at $17 strike, we collect the value of the put, regardless of what happens. If the stock go down to below $17, then the holder of the contract will sell us 100 share of NVAX at $17, but we keep the value of the option.

Setting A Target To Exit The Position. When a stock leads the market down, that is not the investment to buy more of as it falls, it’s an investment to cut our losses on. In any case, panic and fear would have been totally alleviated knowing that we were risking just 5% of $10,000, or $500 in this trade. The stock hit the limit, we're out, and we live to trade again. We would have bought SPR for $79, but the lower limit price we set would not have been to buy more, but rather to sell. We would have set a limit of a 5% loss, which means if SPR hit $75, we would have been a seller.

The Rule Of Double Up. there may come a time when you want to enter a position with double the size. In this case, perhaps a stock drops far enough that the $10,000 investment was hit in two chunks of $5,000 and now the stock is yet lower and it feels like time to buy more.

Porfolio Construction and Planing: A portfolio is a combination of assets designed to serve as a store of value. It will includes long-term financial assets (bonds + common stocks offer higher yield than saving account and certificates of deposit for retirement and child’s education) and short-term assets (saving account). The portfolio should contain a variety of assets (fund to cover unemployment, medical coverage or disability insurance. If the investor has this coverage, more of the portfolio may be directed toward other financial goals. Assets involving greater risk may earn higher returns. Individual should not construct a portfolio all at once but acquire assets on at a time. The decision revolves around which specific asset to purchase: Which mutual fund? Which bond? Which stock? Security analysis considers the merits of the individual asset.

MARGIN AND HOW DOES IT WORK?

What is margin? (Tiền bảo chứng). In finance, the margin is the collateral that an investor has to deposit with their broker or exchange to cover the credit risk the holder poses for the broker or the exchange. An investor can create credit risk if they borrow cash from the broker to buy financial instruments, borrow financial instruments to sell them short, or enter into a derivative contract. Trong tài chính, ký quỹ là tài sản thế chấp mà nhà đầu tư phải ký gửi với nhà môi giới hoặc sàn giao dịch của họ để trang trải rủi ro tín dụng mà người nắm giữ đặt ra cho nhà môi giới hoặc sàn giao dịch. Nhà đầu tư có thể tạo ra rủi ro tín dụng nếu họ vay tiền mặt từ nhà môi giới để mua các công cụ tài chính, vay các công cụ tài chính để bán khống hoặc ký kết hợp đồng phái sinh.

In a normal business context, the margin is the difference between a product or service's selling price and the cost of production, or the ratio of profit to revenue. Margin can also refer to the portion of the interest rate on an adjustable-rate mortgage (ARM) added to the adjustment-index rate. Trong bối cảnh kinh doanh bình thường, tỷ suất lợi nhuận là sự chênh lệch giữa giá bán sản phẩm hoặc dịch vụ và chi phí sản xuất, hoặc tỷ lệ lợi nhuận trên doanh thu. Ký quỹ cũng có thể đề cập đến phần lãi suất trên một khoản thế chấp có lãi suất điều chỉnh (ARM) được thêm vào tỷ lệ chỉ số điều chỉnh.

Buy High and Sell Low With Relative Strength. The goal of investing is to sell something at a price that's higher than what the investor paid to buy it. The idea is to buy the strongest stocks (as measured against the performance of the overall market), hold these stocks while capital gains accumulate, and sell them when their performance deteriorates to the point where they are among the weakest performers. Mua cao và bán thấp với ưu điểm tương đối. Mục tiêu của việc đầu tư là bán cổ phiếu với giá cao hơn giá mà nhà đầu tư đã trả để mua nó. Kế hoạch đây là mua những cổ phiếu tốt nhất (được đo lường dựa trên kết quả toàn thể của thị trường), giữ những cổ phiếu này trong khi lãi vốn tích lũy và bán chúng khi hiệu suất ̣(hiệu năng tính bằng con số cụ thể) của chúng suy giảm đến mức chúng nằm trong số những cổ phiếu có thành tích kém nhất.

Relative Strength. Prices are never too high to begin buying or too low to begin selling. When stocks showing high relative strength they are likely to continue increasing in price, and it is better to buy those stocks than to buy stocks with falling prices.

FINANCIAL TERMS

50-Day Moving Average (xê dịch trung bình trong 50 ngày): It's simply a stock price average over the last 50 days which often acts as a support or resistance level for trading. closing price over the last 50 days. The 50-day average is considered the most important because it's the first line of support in an uptrend (sức mạnh trong một xu hướng tăng) or first line of resistance in a downtrend (sức bền trong một xu hướng giảm).

Allocation (sự phân phối, sự chia phần): To set apart, to reserve or select for a specified purpose. The share or portion allocated. It basically means that Intel have not got enough stock to go to every outlet they supply and someone in the organisation has to make a decision of which CPUs and how many of them are sent out to individual stores.

Asset (của cải, tài sản, vật thuộc quyền sở hữu): A valuable item that is owned. The items detailed on a balance sheet, extrasensory perception or esp.ESP (ngoại cảm) in relation to liabilities and capital. An asset is a resource with economic value that an individual, corporation, or country owns or controls with the expectation that it will provide a future benefit. Assets are reported on a company's balance sheet and are bought or created to increase a firm's value or benefit the firm's operations.

Basic EPS. Income available to parent company common stockholders (Net Income) ÷ (Basic Average Shares) Weighted average number of common shares outstanding. Due to a variety of factors, a company's earnings per share can be negative. While a negative EPS means the company is losing money, it doesn't necessarily mean the company isn't experiencing growth. Lợi tức căn bản mỗi cổ phiếu. Thu nhập thu nhập bình quân dành cho nhà đầu tư của công ty mẹ (Lãi thu nhập) chia (Cổ phiếu cơ bản) Số lượng cổ phiếu thông thường bình quân đang lưu hành. Do nhiều yếu tố, thu nhập trên mỗi cổ phiếu của công ty có thể trừ. Mặc dù lợi tức căn bản trừ có nghĩa là công ty đang thua lỗ, nhưng điều đó không nhất thiết có nghĩa là công ty không phát triển.

- Ex: The Boeing Company Net Income ÷ Basic Average Shares —› BOE Basic EPS: –4,935,000 ÷ 594,578 = –8.30

Bear (sinh lãi, có lãi): A bear market (thị trường sinh lợi) is only bad if you plan on selling your stock or need your money immediately. As a value investor, you typically invest long-term with the intent to hold your shares for decades. A bear market creates a great opportunity to accelerate your returns over longer periods. During a bear market, market sentiment is negative as investors are beginning to move their money out of equities and into fixed-income securities, as they wait for a positive move in the stock market. A bear market describes a stock market decline as a result of negative investor sentiment.

NỘI DUNG TÀI TRỢ

Quảng Cáo Dịch Vụ

Quảng Cáo Sự Kiện

Quảng Cáo Khuyến Mãi

Biểu Trưng & Nhãn hiệu

Grow your business with us. If your company is interested in placing the company’s logo, brand, event invitation, and other promotional banners and flyers here or on any other pages, please reach out to us at ViBa Direct. Thank you for visiting us. Nếu công ty bạn có nhu cầu quảng cáo, đặt biểu trưng, thương hiệu, biểu ngữ mời tham gia thành viên, hội viên cũng như các bích chương quảng cáo khác tại đây hoặc bất kỳ trang nào khác, xin vui lòng liên hệ với chúng tôi.

Beta (sinh lãi, có lãi) is a measure of a stock's volatility relative to the overall market. It is most often calculated using a stock's movements relative to the S&P 500 Index over the trailing 12-month period.

Book Value (Trị giá cổ phiếu trong sổ). The book value of a stock is theoretically the amount of money that would be paid to shareholders if the company was liquidated and paid off all of its liabilities. As a result, the book value equals the difference between a company's total assets and total liabilities.

Bond (kỳ phiếu; trái phiếu): Bonds are traded over the counter, while stocks are traded on exchanges. Governments (at all levels) and corporations commonly use bonds in order to borrow money. Governments need to fund roads, schools, dams or other infrastructure. Similarly, corporations will often borrow to grow their business, to buy property and equipment, to undertake profitable projects, for research and development or to hire employees. When companies or other entities need to raise money, they may issue bonds directly to investors. The borrower (issuer) issues a bond that includes the terms of the loan, interest payments that will be made, and the time at which the loaned funds (bond principal) must be paid back (maturity date). The interest payment (the coupon) is part of the return that bondholders earn for loaning their funds to the issuer. The interest rate that determines the payment is called the coupon rate. The initial price of most bonds is typically set at par, usually $100 or $1,000 face value per individual bond. The actual market price of a bond depends on a number of factors. The credit quality of the issuer, the length of time until expiration, and the coupon rate compared to the general interest rate environment at the time. The face value of the bond is what will be paid back to the borrower once the bond matures. Bonds and bond portfolios will rise or fall in value as interest rates change. The sensitivity to changes in the interest rate environment is called “duration.” The use of the term duration in this context can be confusing to new bond investors because it does not refer to the length of time the bond has before maturity. Instead, duration describes how much a bond’s price will rise or fall with a change in interest rates. Bonds may not necessarily provide the biggest returns, they are considered a fairly reliable investment tool. That's because they are known to provide regular income. As an investor, we should be aware of some of the pitfalls that come with investing in the bond market. Here are the most common risks.

- Interesrt rate is the primary risks associated with the bond market.

- Default risk occurs when the issuer can't pay the interest or principal in a timely manner or at all.

- Inflation risk occurs when the rate of price increases in the economy deteriorates the returns associated with the bond.

Bull (giá lên): A bull market (thị trường nâng giá) is the condition of a financial market in which prices are rising or are expected to rise. Because prices of securities rise and fall essentially continuously during trading, the term "bull market" is typically reserved for extended periods in which a large portion of security prices are rising. Bull markets tend to last for months or even years. Bull markets generally take place when the economy is strengthening. They tend to happen in line with strong gross domestic product (GDP) and a drop in unemployment and will often coincide with a rise in corporate profits. The overall demand for stocks will be positive and investor confidence will also tend to climb throughout a bull market period. In addition, there will be a general increase in the amount of IPO activity during bull markets. How to make money in a bull market? Buy and Hold - Increased Buy and Hold - Retracement Additions.

Capital Gain:(vốn tăng ) An increase in the value of a capital asset (vốn tài sản), such as a stock. Capital gain is an increase in a capital asset's value (giá trị vốn tài sản). It is considered to be realized (nhận ra) when you sell the asset. A capital gain may be short-term (one year or less) or long-term (more than one year) and must be claimed on income taxes.capital asset. Capital gain is denoted as the net profit that an investor makes after selling capital asset exceeding the price of purchase. The entire value earned from selling a capital asset is considered as taxable income. Buildings, lands, houses, vehicles, Mutual Funds, Stocks, and jewelry are a few examples of capital assets. To calculate capital gain.

- Short-term Capital Gain = Final Sale Price – (the cost of acquisition + house improvement cost + transfer cost).

- Long-term Capital Gain = Final Sale Price – (transfer cost + indexed acquisition cost + indexed house improvement cost).

Circuit Breaker (ngắt mạch): Circuit breakers are regulatory measures to temporarily halt in trading on an exchange, which are in place to curb (hạn chế) panic-selling (hoảng hốt, sợ hãi, bán bỏ). They apply both to broad (toàn diện, trên mọi lĩnh vực) market (thị trường) indices (chỉ số so sánh ) such as the S&P 500 as well as to individual securities and exist in the United States as well as in other countries. There are three thresholds that activate the automatic stock-market trading halts amid sharp, substantial downturns and volatility.

- Level 1: Circuit breaker triggers a 15-minute trading pause when the market falls 7% below the prior day’s close.

- Level 2: Trading halt kicks in when the market slides 13%. This pause also lasts 15 minutes.

- Level 3: Circuit breaker is activated when the market drops 20%, suspending trading for the remainder of the day.

Class A Shares: (cổ phiếu cấp A) Class A and Class B. Both have the same right to a company's profits. The main difference is in voting rights. Typically Class A carries more voting rights than the other. Class A shares have ten voting rights per share. It gives the shareholders the privilege of controlling the business as they hold more voting rights than any other investor. Investors who own A share are prioritized over everyone else when the company distributes dividends to its shareholders. A company’s dividend is distributed to investors depending on which category they come under. Investors in such shares are given first preference, and dividends are paid to the first. Investing in these shares provides the investor with a dividend priority. Class A shares are only reserved and offered to the company’s management. It was introduced so that only the company’s management could control significant business decisions. With more votes per share, the primary voting rights lie with the company’s top management. This concentration of decision-making power in top executives’ hands allows the company’s management to focus on long-term growth and build a better business in the future. They are not available to the public, and cannot be traded in the open market. It means that shareholders of such shares cannot sell them to another investor in the secondary stock market.

Class B Shares: (cổ phiếu cấp B) Class B shares are a classification of common stock that may be accompanied by more or fewer voting rights than Class A shares. Class B shares may also have lower repayment priority in the event of a bankruptcy. Class B shares may also refer to mutual fund shares that carry no sales load. In terms of mutual fund designations, commissioned mutual fund brokers typically recommend Class A shares to individual investors. The fund shares have a sales load, or commission, that investors must pay when buying the fund's shares. Investors purchasing large numbers of shares, or who have shares in other funds offered by the same mutual fund company, may receive discounts on the load. Class A shares may have a lower fee, or marketing and distribution fee, than other share classes. Investors purchasing Class B shares may instead pay a fee when selling their shares, but the fee may be waived when holding the shares five years or longer. In addition, Class B shares may convert to Class A shares if held long term. Although the absence of a load means the entire purchase price of the shares is invested into the mutual fund, rather than having a percentage subtracted upfront, Class B shares have higher fee and annual management fees than Class A shares.

Commodities (hàng hoá; loại hàng, mặt hàng) are bulk goods and raw materials, such as grains, metals, livestock, oil, cotton, coffee, sugar, and cocoa, that are used to produce consumer products. The term also describes financial products, such as currency or stock and bond indexes. A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. Commodities are most often used as inputs in the production of other goods or services. When they are traded on an exchange, commodities must also meet specified minimum standards, also known as a basis grade. Commodities are split into two types: hard and soft commodities. Hard commodities are typically natural resources that must be mined or extracted—such as gold, rubber, and oil, whereas soft commodities are agricultural products or livestock—such as corn, wheat, coffee, sugar, soybeans, and pork. Investing in commodities can be dangerous because when dealing with raw materials, supply and demand is unpredictable. Though everyone knows the stock market is a risky game to play, with constant ebbs and flows, commodities can be an even bigger risk.

Common Stock: (cổ phiếu phổ thông) Stocks are divided into two broad categories: common and preferred. Common stock gives shareholders ownership in the company as well as voting rights, in most cases. Holders of common shares also will receive dividends if the company offers them, although they typically pay lower and the amount can fluctuate. There's more potential for long-term growth in share prices but share prices tend to be more volatile.

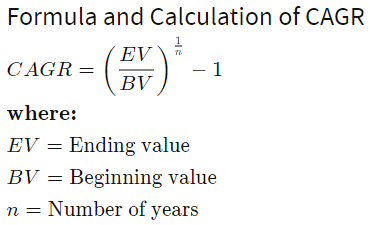

Compound Annual Return (lợi tức kép hàng năm): The compound return is the rate of return, usually expressed as a percentage, that represents the cumulative effect that a series of gains or losses has on an original amount of capital over a period of time.  When expressed in annual terms, a compound return can be referred to as a Compound Annual Growth Rate. CAGR, is the mean annual growth rate of an investment over a specified period of time longer than one year. It represents one of the most accurate ways to calculate and determine returns for individual assets, investment portfolios, and anything that can rise or fall in value over time. To calculate the compound average return.

When expressed in annual terms, a compound return can be referred to as a Compound Annual Growth Rate. CAGR, is the mean annual growth rate of an investment over a specified period of time longer than one year. It represents one of the most accurate ways to calculate and determine returns for individual assets, investment portfolios, and anything that can rise or fall in value over time. To calculate the compound average return.

- Divide the value of an investment at the end of the period by its value at the beginning of that period.

- Raise the result to an exponent of one divided by the number of years.

- Subtract one from the subsequent result.

Convertible Bond: (Hoán Đổi Trái Phiếu) A convertible bond is a fixed-income corporate debt security that yields interest payments, but can be converted into a predetermined number of common stock or equity shares. The conversion from the bond to stock can be done at certain times during the bond's life and is usually at the discretion (sự tự do làm theo ý mình) of the bond holder.

Corporate Bond:(Trái Phiếu Công Ty) These bonds are issued by companies. Companies issue bonds rather than seek bank loans for debt financing in many cases because bond markets offer more favorable terms and lower interest rates.

Coupon Date: It's the dates on which the bond issuer will make interest payments. Payments can be made in any interval (khoảng thời gian), but the standard is semiannual payments.

Coupon Rate: It's the rate of interest the bond issuer will pay on the face value of the bond, expressed as a percentage. Ex: A 7% coupon rate means that bondholders will receive 7% x $1000 face value = $70 every year. Credit rating and time to maturity are the principal determinants of a bond's coupon rate. If the issuer has a poor credit rating, the risk of default is greater, and these bonds pay more interest. Bonds that have a very long maturity date also usually pay a higher interest rate. This higher compensation is because the bondholder is more exposed to interest rate and inflation risks for an extended period. The highest quality bonds are called “investment grade” it includes debt issued by the U.S. government and very well established companies, like many utilitie companies.

Currency is the physical money in an economy, comprising the coins and paper notes in circulation. Currency makes up just a small amount of the over all money supply, much of which exists as credit money or electronic entries in financial ledgers. The eight most traded currencies are the U.S. dollar (USD), the Canadian dollar (CAD), the euro (EUR), the British pound (GBP), the Swiss franc (CHF), the New Zealand dollar (NZD), the Australian dollar (AUD) and the Japanese yen (JPY).

SPONSORED CONTENT

Your Service Flyer

Your Event Invitation

Your Promotion Ads

Your Logo & Brand

Debt to Asset ot Total-debt-to-total-assets (nợ tài sản) is a leverage ratio that defines the total amount of debt relative to assets owned by a company. The higher the ratio, the higher the degree of leverage (DoL) and, consequently, the higher the risk of investing in that company. A lower debt-to-asset ratio suggests a stronger financial structure, just as a higher debt-to-asset ratio suggests higher risk. Generally, a ratio of 0.6% – 40% or lower is considered a good debt ratio.

Defunct: No longer in effect, use, valid or operative. The condition of a company, whether publicly traded or private, that has gone bankrupt and has ceased to exist. Depending on the company and the circumstances of its disappearance, the certificates may have value if the firm lived on through a merger or they may be no more than a conversation piece. In any case, the quest to discover their value can be intriguing and informative, as well as potentially financially rewarding.

DJI - Dow Jones Industrial Average: A stock market index that measures the stock performance of 30 large companies listed on stock exchanges in the United States. Companies mades up the DJI are Wal-Mart Stores, Inc. (WMT) – Merch & Co., Inc. (MRK) – McDonald's Corporation (MCD) – The Walt Disney Company (DIS) – Microsoft Corporation (MSFT) – Apple Inc. (AAPL) – American Express Company (AXP) – 3M (MMM) – Boeing (BA) – Coca-Cola (KO) – Catepilla (CAT) – Chevron (CVX) – DowDuPond )DD) – ExxonMobil (XOM) – General Electric (GE) – Goldman Sachs (GS) – IBM (IBM) – The Home Depot (HD) – Intel (INTC) – Nike (NKE) – Johnson & Johnson (JNJ) – Pfizer (PFE) – JPMorgan Chase (JPM) – Procter & Gamble (PG) – United Technologies (RTX) – Visa (V) – Verizon (VZ) – UnitedHealth (UNH) – Travelers Companies, Inc. (TRV). Dating to 1885, DJI's the second-oldest active market index, after sibling Dow Jones Transportation Average, and DJI's the most widely covered.

Diversification (Đa dạng hóa) is an investing strategy used to manage risk. Rather than concentrate money in a single company, industry, sector or asset class, investors diversify their investments across a range of different companies, industries and asset classes. Diversification is a core principle of investing.

Diversified Fund (Quỹ đa dạng) refers to pooled investments that build portfolios across several asset classes, regions, and/or industry sectors. Diversification is a key investment strategy for reducing systematic risk in a portfolio while maintaining levels of expected return. Example of diversified funds are Axis Long Term Equity Fund, BNP Paribas Long Term Equity Fun, Canara Robeco Equity Taxsaver fund, DSP Tax SaverFund, ICICI Prudential Long Term Equity Fund Tax Saving, Mirae Asset Tax Saver Fund, and SBI Magnum Long Term Equity Fund Tax Saving.

Quỹ Đa dạng hóa đề cập đến tổng hợp các khoản đầu tư và lập ra danh mục đầu tư dựa trên nhiều loại tài sản, qua nhiều hạng và / hoặc nhiều lĩnh vực công nghiệp. Đa dạng hóa là một chiến lược đầu tư quan trọng để giảm rủi ro có trong hệ thống danh mục đầu tư trong khi vẫn duy trì mức lợi nhuận căn bản.

Dividend Yield (lợi tức cổ phần) is a financial ratio that tells you the percentage of a company's share price that it pays out in dividends each year. For example, if a company has a $18 share price and pays a dividend of $0.45 per year, its dividend yield would be 2.5%. Assuming (giả định) the dividend is not raised or lowered, the yield will rise when the price of the stock falls. And conversely, it will fall when the price of the stock rises. Stocks with dividend yield over 6% is risky, which will lead to declining stock prices and investment losses.

- Dividend yield = annual dividends per share ÷ price per share

Dollar-Cost Averaging: The basic idea of dollar-cost averaging is to invest and rather than putting it all in at once and taking the risk of what happens with the market immediately, We're going to break it up and invest systematically over time. And as dollar-cost averaging implies, we're going to do it with fixed dollar amounts. So, if we have got $10,000 to put in, instead of putting in $10,000 all at once, we're going to put in $2,000 a month over the next five months. How does it works in our favor? If that investment goes up while we're waiting we end up buying fewer shares, because it costs a little bit more for our fixed $2,000. If the investment goes down, we end up buying more shares because our $2,000 goes further. And what we end up with over the span of several months is often we find that the average cost of the shares ends up lower than they would have been buying all at once, simply because of the random market volatility and noise that happens along the way. So the idea of this is to buy fewer shares when they are up, and buy more shares when they are down, that lets us get a lower average weighted cost. Ultimately that gets us a better upside potential in the long run for the investment.

EBIT or Earnings Before Interest and Tax. (Thu nhập trước lãi và thuế) EBIT is also sometimes referred to as operating income because it’s found by deducting all operating expenses (production and non-production costs) from sales revenue. Earnings Before Interest and Taxes can be calculated as follow...

- EBIT = Net Income + Interest + Taxes

EPS or Earnings per Share (lợi tức mỗi cổ phiếu) refers to a company's profits divided by its number of shares; it's a basic measure of a company's profitability. EPS indicates how much money a company makes for each share of its stock, and is a widely used metric to estimate corporate value. If a company has annual profits of $1 billion, with 2 billion shares outstanding, the EPS is 50 cents. A high EPS means that a company is capable of paying investors lucrative dividends. If a company's EPS is growing every year, it's selling a product that customers value.

- EPS or Earning per Share = annual profit ÷ outstanding shares. Ex: Intel = $57.58 ÷ 11.27 = 5.11 is Intel EPS

Enterprise Value/EBITDA: Earnings Before Interest, Taxes, Depreciation (sự sụt giá, sự giảm giá), and Amortization (nợ trừ dần). It's a metric used to evaluate a company’s operating/overall finance performance. It can be seen as a proxy (sự uỷ nhiệm, sự uỷ quyền, đại diện) for cash flow from the entire company’s operations. EBITDA helps investor analyze and compare profitability between companies and industries, as it eliminates the effects of financing, government or accounting decisions. This provides a rawer, clearer indication of investor earnings. EBITDA measures a firm's overall financial performance, while EV determines the firm's total value.

Enterprise Value (EV) : It's a measure of a company’s total value, often used as a more comprehensive alternative to equity market capitalization. The market capitalization of a company is simply its share price multiplied by the number of shares a company has outstanding. Enterprise value is calculated as the market capitalization plus debt, minority interest and preferred shares, minus total cash and cash equivalents. Often times, the minority interest and preferred equity is effectively zero, although this need not be the case. Giá trị doanh nghiệp. Đây là thước đo tổng giá trị của một công ty, thường được sử dụng như một biện pháp thay thế toàn diện hơn cho vốn hóa thị trường cổ phiếu.

- EV = market value of common stock + market value of preferred equity + market value of debs + minority interest – cast and investments.

Enterprise Value/Revenue (EV/R): The enterprise value-to-revenue multiple (EV/R) is a measure of the value of a stock that compares a company's enterprise value to its revenue. EV/R is one of several fundamental indicators that investors use to determine whether a stock is priced fairly. The ratio is, strictly speaking, denominated in years; it demonstrates how many dollars of EV are generated by one dollar of yearly sales. Generally, the lower the ratio, the cheaper the company is. EV-to-Revenue multiples are typically considered healthy when between 1x and 3x. If this ratio is higher, then it's considered that the stocks are over-valued, and it's not profitable for investors to invest in the company.

Face Value: It's the value the bond will be worth at maturity. It is also the reference amount the bond issuer uses when calculating interest payments. Ex: If we purchases a bond at a premium $1,000 and another investor buys the same bond later when it is trading at a discount for $990. When the bond matures, both investors will receive the $1,000 face value of the bond.

Floating Shares: Shares of a public corporation that are available for trading in a stock market. The number of floating shares may be smaller than the company’s outstanding shares if founding partners, other groups with a controlling interest, or the company’s pension fund, employee stock ownership plan (ESOP), or similar programs hold shares in their portfolios that they aren’t interested in selling.

Forward P/E is the estimated price-earnings ratio tỷ lệ ước tính trên giá thu nhập for the future earnings of a business. The forward price-earnings ratio is not widely distributed, for it is based on a company's guidance, which may change as management revises its estimates for future earnings. Some companies prefer to issue excessively conservative guidance, so that they can more easily beat their own earnings estimates.

Growth Stock: Growth stocks are companies that increase their revenue and earnings faster than the average business in their industry or the market as a whole. A growth company has developed an innovative product or service that is gaining share in existing markets, entering new markets, or even creating entirely new industries. Growth stocks tend to be more expensive than the average stock in terms of metrics like price-to-earnings, price-to-sales, and price-to-free-cash-flow ratios. A growth company is a company that possess strong competitive advantages. Some competitive advantages are: Network effects, Scale advantages, High switching costs, Large addressable markets. To find growth stocks:

- Identify powerful long-term market trends and the companies best positioned to profit from them

- Narrow your list to businesses with strong competitive advantages

- Narrow your list to companies with large addressable markets

GAAP: Generally Accepted Accounting Principles is the accounting standard adopted by the U.S. Securities and Exchange Commission. Generally accepted accounting principles, or GAAP, are a set of rules that encompass the details, complexities, and legalities of business and corporate accounting. The Financial Accounting Standards Board (FASB) uses GAAP as the foundation for its comprehensive set of approved accounting methods and practices. What is GAAP in detail?

Goverment Bonds are issued by the U.S. Treasury. Bonds issued by the Treasury with a year or less to maturity are called “Bills”; bonds issued with 1–10 years to maturity are called “notes”; and bonds issued with more than 10 years to maturity are called “bonds”. The entire category of bonds issued by a government treasury is often collectively referred to as "treasuries." Government bonds issued by national governments may be referred to as sovereign debt. Công Khố Phiếu được phát hành bởi Kho bạc Hoa Kỳ. Công Khố Phiếu do Kho bạc phát hành có thời gian đáo hạn từ một năm trở xuống được gọi là “Hối phiếu”; Công Khố Phiếu phát hành có thời hạn từ 1–10 năm được gọi là “Trái phiếu”; và Công Khố Phiếu phát hành trên 10 năm đến ngày đáo hạn được gọi là “Khế ước”. Toàn bộ Công Khố Phiếu do kho bạc chính phủ phát hành thường được gọi chung là "công khố". Trái phiếu chính phủ do chính phủ các quốc gia phát hành có thể được coi là nợ có chủ quyền.

Hedge: A hedge (phòng hộ "Che chắn để bảo vệ") is an investment to reduce the risk of adverse (ngược) price movements in an asset. Normally, a hedge consists of taking an offsetting position in a related security. Ex: In a card game, if the dealer shown an Ace, you'll want to protect your bet from the posibility of (21) Blackjack - to hedge it, by taking out insurance. There is a risk-reward tradeoff inherent in hedging; while it reduces potential risk, it also chips away at potential gains.

Hedge Fund is an investment fund that trades in relatively liquid assets (tài sản lưu động) and is able to make extensive use of more complex trading, portfolio-construction and risk management techniques to improve performance, such as short selling, leverage and derivatives (các dẫn xuất). Quỹ Phòng Hộ là một quỹ đầu tư kinh doanh các tài sản tương đối thanh khoản và có thể sử dụng rộng rãi các kỹ thuật giao dịch, xây dựng danh mục đầu tư và quản lý rủi ro phức tạp hơn để cải thiện hiệu suất (Hiệu năng tính bằng con số cụ thể), chẳng hạn như bán thiếu, đòn bẩy và các công cụ phái sinh (Ex: Một từ đa nghĩa có một nghĩa gốc và nhiều nghĩa phái sinh "kiểu cấu tạo từ mới, nhờ sử dụng phụ tố theo quy tắc cấu tạo từ của một ngôn ngữ".).

NỘI DUNG TÀI TRỢ

Quảng Cáo Dịch Vụ

Quảng Cáo Sự Kiện

Quảng Cáo Khuyến Mãi

Biểu Trưng & Nhãn hiệu

Grow your business with us. If your company is interested in placing the company’s logo, brand, event invitation, and other promotional banners and flyers here or on any other pages, please reach out to us at ViBa Direct. Thank you for visiting us. Nếu công ty bạn có nhu cầu quảng cáo, đặt biểu trưng, thương hiệu, biểu ngữ mời tham gia thành viên, hội viên cũng như các bích chương quảng cáo khác tại đây hoặc bất kỳ trang nào khác, xin vui lòng liên hệ với chúng tôi.

Implied Volatility (IV): In finance, the implied volatility of an option contract is the value of the volatility of the underlying instrument which, when input in an option pricing model, will return a theoretical value equal to the current market price of said option. Implied volatility shows how much movement the market is expecting in the future. Options with high levels of implied (hàm ý, ngụ ý) volatility (không kiên định, không ổn định) suggest that investors in the underlying (cơ bản, ưu đãi) stocks are expecting a big move in one direction or the other. It could also mean there is an event coming up soon that may cause a big rally or a huge sell-off. However, implied volatility is only one piece of the puzzle when putting together an options trading strategy.

Income: The flow of money or its equivalent produced by an asset; dividends and interest.

Index Fund: An index fund is a type of mutual fund or exchange-traded fund (ETF) with a portfolio constructed to match or track the components of a financial market index, such as the Standard & Poor's 500 Index (S&P 500). Index funds are a low-fee, no-fuss way to invest. It might be the smartest and easiest investment because index funds are low-risk, investors will not make the large gains that they might from high-risk individual stocks. Index Funds are affordable and well diversified, and they tend to generate solid returns over time, outperforming actively managed funds from the top investment firms. There's no universally agreed upon time to invest in index funds but ideally, we want to buy when the market is low and sell when the market is high. The disadvantage is if a big company is starting to crash, the market value may potentially fall a lot before it falls out of the index, while a mutual fund or an individual investor might have been able to sell it long before it was too late. Index funds buy high and sell low

INX - S&P 500 Index: The S&P 500, or Standard & Poor's 500 Index is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices, and many consider it to be one of the best representations of the U.S. stock market. The top 10stocks driving the SP 500 are Apple Inc (AAPL), Microsoft Corp (MSFT), Amazon.co Inc. (AMZN), Facebook Inc. (FB), Alphabet Inc. Class A Shares (GOOGL), Alphabet Inc. Class C Shares (GOOG), Johnson & Johnson (JNJ), Bershire Hathaway Inc. (BRK.B), Procter & Gamble (PG), Visa, Inc. (V).

IRA: Individual Retirement Account have tax benefits and higher earning capabilities than regular savings accounts. IRAs can be opened at a bank, with a mutual fund or life insurance company, or through a stock broker. Amounts rolled over into an IRA don’t count against limits, and contributions can be made anytime during the year or by the due date for filing tax return for that year. There are certain kinds of income that don’t qualify, only earning income is qualied an IRA contribution. Profits from the sale of real estate, earned interest and annuity income don’t count, while self-employment income, commissions and alimony pay do. For traditional IRAs, you have until the year you turn 70 1/2 to make contributions, while Roth IRAs have no age restrictions. IRAs are individual accounts, as the name suggests, and cannot be shared or opened jointly. The earnings from your IRAs grow completely tax-free. With Roth IRAs, your contribution is made with income that has already been taxed, allowing qualified withdrawals to be non-taxable. Contributions made to traditional IRAs are tax-deductible. The amount of your adjusted gross income, whether or not you're participating in an employee sponsored plan such as a 401(k), and whether filing alone or jointly will all be factors when determining tax deductibility.

Investment: Purchase of an asset for the purpose of storing value (and, it is hoped, increasing that value over time. The purchases of stocks, bonds, options, commodity contracts, and real estate are all considered to be investments if the individual’s intent is to transfer purchasing power to the future. If these assets are acting as stores of value, they are investments for that individual.

Market Capitalization (MCAP): Market Cap (giá trị thị trường) represents the aggregate (tổng số) value of a company or stock. It is obtained by multiplying the number of shares outstanding by their current price per share. For example, if NVAX company has 23,470,000 shares outstanding and a share price of $53.21 per share then the market capitalization is 23,470,000 x $53.21 = $1,248,838,700. Generally, the U.S. market recognizes three market cap divisions: large cap (usually $5 billion and above), mid cap(usually $1 billion to $5 billion), and small cap (usually less than $1 billion), although the cutoffs between the categories are not precise or fixed. Companies with a large market cap usually move similarly to the markets, where companies with small market caps might show more volatility.

Mature Date: It's the date on which the bond will mature and the bond issuer will pay the bondholder the face value of the bond.

Minority Interest (Lợi ích nhỏ) is the holding of a stake by the investors, which is less than 50% of the existing shares or the voting rights in the company. Therefore, they do not have control over the company through their voting rights, having a little role in making its decisions. Lợi ích thiểu số nghĩa là người chủ sở hữu một phần tài sản của công ti cổ phần dưới 50% số cổ phần hiện có hoặc quyền biểu quyết trong công ty. Do đó, họ không có quyền kiểm soát công ty thông qua quyền biểu quyết của mình, nên không có vai trò trong việc đưa ra các quyết định của công ty.

Moving Average Convergence Divergence (MACD): It's a trend-following momentum indicator that shows the relationship between two moving averages of a security's price. ̣(Mức trung bình xê dịch khác nhau là xu hướng báo động cho thấy mối quan hệ của đường trung bình giữa hai giá chứng khoán). This technical indicator is a tool that's used to identify moving averages that are indicating a new trend, whether it's bullish or bearish. Traders may buy the security when the MACD crosses above its signal line and sell—or short—the security when the MACD crosses below the signal line, that is where the most money is made.

Municipal Bond: They are issued by states and municipalities. Some municipal bonds offer tax-free coupon income for investors.

Mutual Fund is a professionally managed investment fund that pools money from many investors to purchase securities. Mutual fund investors own shares in a company whose business is buying shares in other companies. Mutual fund investors don’t directly own the stock in the companies the fund purchases, but they do share equally in the profits or losses of the fund’s total holdings — hence the “mutual” in mutual funds.

Nasdaq Composite - IXIC: Along with the Dow Jones Industrial Average and S&P 500 Index, NASDAQ Composite is one of the three most-followed stock market indices in the United States. The NASDAQ Composite stock index is designed to track the value changes of the full NASDAQ market. The NASDAQ Composite index includes almost every security listed in the NASDAQ exchange, over 2,500 in total. Included in the index are all listed common stocks, limited partnerships, real estate investment trusts and American Depository Receipts. Traditionaly, tech stocks have made up a large portion of the NASDAQ composite, with larger tech companies especially influencing the total composite index. The NASDAQ launched in 1971 to provide electronic and listing services for companies that had been trading over-the-counter, not on any exchange. The NASDAQ became the listing place for many of the new and innovative companies of the high tech era. Companies such as Intel, Microsoft and Apple initially raised money by listing on the NASDAQ and remain on the exchange today. Not included in the index are any closed-end funds, exchange-traded funds, convertible securities, preferred shares or derivative securities listed on the exchange. The NASDAQ Composite is classified as a broad-based stock market index.

Net Income (thu nhập lợi tức). The profit of a business after deducting expenses. Net income is the money that you actually have available to spend. It is equal to your total income minus tax payments and pretax contributions. Investor refer to net income as net earnings, net profit, or the company’s bottom line. It’s the amount of money company have left over to pay shareholders, invest in new projects or equipment, pay off debts, or save for future use. The formula for calculating net income is:

- Revenue – Cost of Goods Sold – Expenses = Net Income or

- Gross Income – Expenses = Net Income or

- Total Revenue – Total Expenses = Net Income

Net Profit (thu nhập lợi nhuận) is the gross profit (revenue minus COGS) minus operating expenses and all other expenses, such as taxes and interest paid on debt. Although it may appear more complicated, net profit is calculated for us and provided on the income statement as net income. While there are several types of profit margin, the most significant and commonly used is net profit margin, a company's bottom line after all other expenses, including taxes and one-off oddities, have been removed from revenue.

- Total Revenue (period of time) ÷ Total Expenses (period of time) = Net Profit

Net Profit Margin ('Lãi Suất' số chênh lệch giữa giá vốn và giá bán) is one of the most important indicators of a company's overall financial health. Net Profit Margin includes all factors in a company's operations, it measures how much net income is generated as a percentage of revenues received. Its helps investors assess if a company's management is generating enough profit from its sales and whether operating costs and overhead costs are being contained.

Non-GAAP Financial Measure is a numerical measure that adjusts the most directly comparable GAAP measure reported on the audited financial statements. Common non-GAAP measures include earnings before interest, taxes, depreciation and amortization (EBITDA); adjusted EBITDA; and non-GAAP income.

SPONSORED CONTENT

Your Service Flyer

Your Event Invitation

Your Promotion Ads

Your Logo & Brand

Non-diversified Fund concentrate their efforts in a single industry or geographic sector. Non-diversified funds often rise and fall with events and economic conditions because those factors similarly affect most businesses in the sector. With more risk comes the possibility of substantial gains if the sector does well. An event or condition can benefit one sector of funds and hurt another. Opting for non-diversified funds, can reap higher returns if the stocks are picked correctly.

Operating Expenses: When a company's operating expenses exceed its revenue, this means it is not currently profitable. This is a common scenario for newer companies, so it may or may not be a negative signal for investors. For an unprofitable company, it is also important to look at how Net Income is changing over time. Net Income is how much money is left over from their revenue after the company pays its operating costs.

Operating Income: A company’s operating income is how much profit it nets after it pays its operating costs. Companies who can cover their costs quite well might invest that extra cash into new acquisitions, new projects, or paying dividends to their shareholders. In rare cases, too much operating cash might indicate a lack of direction of growth for the company.

Preferred Stock: (cổ phiếu ưu đãi) Stocks are divided into two broad categories: common and preferred. Shareholders choose preferred stock to collect income through dividends. Preferred stock is kind of a form of debt, and equity, which is a form of ownership. Typically, shareholders of preferred stock will receive guaranteed fixed dividends. Additionally, if a company goes bankrupt or liquidates its assets, preferred shareholders get paid out before holders of common shares. Thus, preferred stock tends to be less volatile than common stock. If the dividends become too high relative to the market the company can force shareholders to sell them back at the redemption price, or call price.

Price/Earnings-to-Growth (PEG) Ratio: The PEG ratio (Giá/Thu nhập để tăng trưởng) is a company’s Price/Earnings ratio divided by its earnings growth rate over a period of time (typically the next 1-3 years). The PEG ratio adjusts the traditional P/E ratio by taking into account the growth rate in earnings per share that are expected in the future. This can help “adjust” companies that have a high growth rate and a high price to earnings ratio. In general, a good PEG ratio has a value lower than 1.0. PEG ratios greater than 1.0 are generally considered unfavorable, suggesting a stock is overvalued. Meanwhile, PEG ratios lower than 1.0 are considered better, indicating a stock is relatively undervalued.

- PEG = (Share Price ÷ Earnings per share) ÷ Earnings per share growth rate

Price/to-Earnings (P/E) Ratio. This compares a company's market share price (tỷ lệ giá thị trường) to its annual EPS/Earning per Share (Lợi tức mỗi cổ phiếu). Example: Suncor Energy, Inc. shares were selling at $31.82, and the company had an EPS for the year of $5.11. Thus its (P/E) Price-earning ratio (Tỷ lệ giá trên thu nhập) was 6.23. Normally, P/E ratios have averaged around 16, but the average fluctuates widely from year to year; there is no "normal" P/E. The higher the P/E ratio, the more investors are paying for each dollar of the company's earnings. That could mean that the stock is overvalued, or it could reflect optimism for the company's future. Tỷ lệ giá trên thu nhập. Để so sánh giá cổ phiếu thị phần (là tỷ lệ phần trăm giữa doanh thu bán ra của doanh nghiệp) của một công ty với thu nhập hàng năm trên mỗi cổ phiếu. Ví dụ: Cổ phiếu của Suncor Energy, Inc. được bán với giá $31.82 đô la và công ty có giá thu nhập cổ phần trong năm là $5.11 đô la. Như vậy tỷ lệ Giá thu nhập (P/E) của Suncor Energy, Inc là 6.23. Thông thường, các chỉ số Giá thu nhập trung bình ở mức số 16, nhưng mức trung bình này dao động khá lớn giữa các năm; cho nên giá thu nhập thường "lên xuống". Tỷ lệ Giá thu nhập càng cao, thì nhà đầu tư phải trả cao hơn cho mỗi đô la thu nhập của công ty. Điều đó có thể có nghĩa là cổ phiếu được định giá cao hơn, hoặc nó có thể phản ánh sự lạc quan cho tương lai của công ty.

- P/E ratio or Price-to-earning ratio = stock share price ÷ price earning per share. Ex: SU P/E ratio = 31.82 ÷ 5.11 = 6.23

- Giá cổ phiếu ÷ giá thu nhập trên mỗi cổ phiếu = Tỷ lệ trên giá thu nhập. Cái này so sánh cổ phiếu của một công ty với thu nhập trên mỗi cổ phiếu hàng năm.

Portfolio: An accumulation (sự tích lũy, sự tích thêm vốn do lãi ngày một đẻ ra) of assets owned by the investor and designed to transfer purchasing power to the future.

Price-to-Book Ratio (tỷ lệ giá mua trước). Price-to-book value (P/B) is the ratio of the market value of a company's shares (share price) over its book value of equity. The book value of equity, in turn, is the value of a company's assets expressed on the balance sheet. The book value is defined as the difference between the book value of assets and the book value of liabilities. The price-to-book ratio (P/B) offers investors an effective approach to finding undervalued companies. The P/B ratio can also help investors identify and avoid overvalued companies. However, the P/B ratio should be compared with companies within the same sector. Tỷ lệ Giá trên Sổ Sách là tỷ số giữa giá trị thị trường cổ phiếu của một công ty (giá cổ phiếu) trên giá trị sổ sách của vốn chủ sở hữu. Giá trị sổ sách của vốn chủ sở hữu, là giá trị tài sản của một công ty được thể hiện trên bảng cân đối kế toán. Giá trị ghi sổ được xác định là sự chênh lệch giữa giá trị tài sản ghi trong sổ và giá trị ghi sổ của nợ phải trả. Tỷ lệ giá Giá trên Sổ Sách cung cấp cho các nhà đầu tư một cách tiếp cận hiệu quả để tìm kiếm các công ty bị định giá thấp. Tỷ lệ Giá trên Sổ Sách cũng có thể giúp các nhà đầu tư xác định và tránh các công ty được định giá quá cao. Tuy nhiên, tỷ lệ Giá trên Sổ Sách nên được so sánh với các công ty cùng ngành.

- Low Price-to-Book Ratio: A P/B ratio with lower values, particularly those below 1, could be a signal to investors that a stock may be undervalued and is trading at a lower price relative to the value of the company's assets. A low P/B ratio could also mean the company earning is poor (even negative) return on its assets. If the company has poor earnings performance, there is a chance that new management or new business conditions will prompt a turnaround in prospects and give strong positive returns. Even if this does not happen, a company trading at less than book value can be broken up for its asset value, earning shareholders a profit. A P/B ratio of less than one could be an indicator of an undervalued company that the market has misunderstood. Tỷ lệ giá trong sách thấp với các giá trị thấp hơn, đặc biệt là những giá thấp hơn 1, có thể là một tín hiệu cho các nhà đầu tư rằng một cổ phiếu có thể bị định giá thấp và đang được mua bán ở mức giá thấp hơn so với giá trị tài sản của công ty. Tỷ lệ Giá trên Sổ Sách thấp cũng có thể có nghĩa là công ty kiếm được lợi nhuận kém (thậm chí là lổ) trên tài sản của mình. Nếu công ty có hiệu suất thu nhập kém, có thẻ vì ban quản lý mới hoặc các điều kiện kinh doanh mới đả tạo ra sự thay đổi trong triển vọng và mang lại lợi nhuận tốt. Ngay cả khi điều này không xảy ra, một công ty giao dịch ở mức thấp hơn giá trị trong sổ sách có thể bị chia nhỏ cho giá trị tài sản của nó, mang lại lợi nhuận cho cổ đông. Tỷ lệ giá trong sách nhỏ hơn 1 cũng có thể là một chỉ báo của một công ty bị định giá thấp mà thị trường đã hiểu sai.

- High Price-to-Book Ratio: High price-to-book ratios might be bad news for investors, as they can signify a stock is overvalued. The market is excited about the company’s prospects, driving share prices up more quickly than projected growth supports. However, high price-to-book ratios aren’t always a result of overvalued stock. In some cases, the company is generating strong returns on assets, or it owns valuable intellectual property that doesn’t show up on the balance sheet. Generally speaking, a higher price-to-book ratio can’t be classified as “better” than a low price-to-book ratio. These figures are relative based on the industry and the mix of intangible assets and growth prospects unique to each company. Tỷ lệ giá trong sách cao có thể là tin xấu đối với các nhà đầu tư, vì chúng có thể cho thấy một cổ phiếu được định giá quá cao. Thị trường đang háo hức với triển vọng của công ty, khiến giá cổ phiếu tăng nhanh hơn mức hỗ trợ tăng trưởng dự kiến. Tuy nhiên, tỷ lệ giá trong sách cao không phải lúc nào cũng là kết quả của việc cổ phiếu được định giá quá cao. Trong một số trường hợp, công ty đang tạo ra lợi nhuận cao từ tài sản hoặc công ty sở hữu tài sản hợp lý có giá trị không thấy rõ ràng trên bảng cân đối kế toán. Nói chung, tỷ lệ giá trên sách cao hơn không thể được phân loại là “tốt hơn” so với tỷ lệ giá trong sách thấp. Những con số này tương đối dựa trên ngành công nghiệp và sự kết hợp của tài sản vô hình và triển vọng tăng trưởng duy nhất cho mỗi công ty.

Principal: The invested amount of money is called principal. Frequent investing adds to the size of your principal, thus magnifying your return.